From Doubt to Decentralization: My Journey in Cryptocurrency

It feels surreal to think back to 2015, the year everything started. I was just another college student, caught up in the whirlwind of assignments, social events, and figuring out what I wanted to do with my life. I didn’t have any grand plans or ambitions, just the usual uncertainty that most 20-year-olds carry with them. Then, one night, while scrolling through some random financial blog, I stumbled upon a term I’d never heard before: Bitcoin. At the time, I had no idea what it was, and like most people, I thought it was just another internet gimmick.

But something about it intrigued me. The idea of a decentralized currency, completely outside the control of governments or banks—just peer-to-peer transactions. It was revolutionary, and I knew I had to learn more.

2015: The First Step

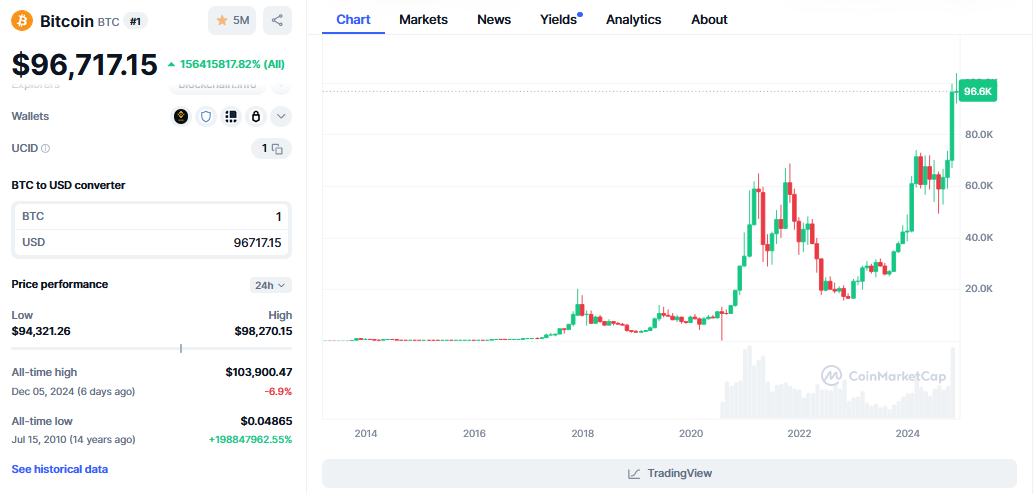

I remember the first time I bought Bitcoin. It was a small amount, just $100 worth, and I had no clue what I was doing. I signed up for an exchange, made a purchase, and then… had no idea what to do with it. I stored it in a wallet on my computer, unsure whether I’d made a good decision or a terrible one. There was a lot of fear and uncertainty back then. Bitcoin was still trading at around $300-$400, and the world was largely skeptical about its future.

I didn’t even tell my friends about it; I didn’t want to look foolish if it turned out to be a scam. But I kept an eye on the market, and I followed the crypto news obsessively. There were whispers of other coins—Ethereum, Litecoin, and a handful of others—emerging onto the scene. It felt like I was part of something underground, something that could change the world.

But 2015 was still early. The hype hadn’t fully hit yet, and my investments felt more like an experiment. I never expected to get rich. It was more about being part of this new digital frontier.

2016-2017: The Wild Ride

Then came 2016, and things started to pick up. More people were talking about blockchain technology, and Ethereum was gaining traction. I had started doing more research into altcoins, and I saw the potential in Ethereum’s smart contracts. I decided to diversify and threw a bit of money into Ethereum. The year 2017 was where everything changed.

The market exploded. Bitcoin hit $1,000, then $3,000, then $10,000, and Ethereum followed its own meteoric rise. It was an incredible feeling—watching my portfolio grow and grow. I began telling a few friends about my investments, and some of them joined in, buying Bitcoin and Ethereum as well. I felt like I was in the right place at the right time.

The whole world was talking about cryptocurrency. ICOs (Initial Coin Offerings) became a thing, and every week there seemed to be a new coin with a promise of revolutionizing some industry. I got caught up in the excitement and invested in a few of them. Some of those coins were complete scams, but others turned out to be gems, like Chainlink and Polkadot, both of which I bought relatively early.

By the end of 2017, my portfolio had skyrocketed in value. I was ecstatic. I had become a part of something bigger, something that was reshaping the financial world. But looking back, I realize that 2017 was also a lesson in overconfidence. I got greedy, and I made some poor investment choices. The market was too hot, and I was too eager to chase profits. When the bubble burst in early 2018, I lost a significant chunk of my gains.

2018-2019: The Winter

The crash in 2018 hit hard. The market corrected itself, and the value of my holdings plummeted. Bitcoin dropped from $20,000 to around $3,000, and many altcoins lost 90% of their value. It was a dark time. I was frustrated, questioning my decisions. I could have cashed out and made a profit, but instead, I let the greed and excitement blind me.

It was during the bear market that I learned the true value of patience and long-term thinking. Instead of selling off my assets, I held on. The world was still learning about blockchain and cryptocurrency, and I knew that this technology wasn’t going away. It was just a matter of time before the next cycle came around.

2019 felt like a year of rebuilding. I began focusing more on research, reading whitepapers, and understanding the underlying technology. I shifted my focus from trading to long-term investing. I looked for projects that had real utility, and I invested more heavily in Ethereum, which had the potential to become the backbone of decentralized applications. I also took a gamble on newer projects like Polkadot and Tezos, which I believed had solid fundamentals.

2020-2021: The Bull Run

By 2020, things were looking better. The market was beginning to recover, and cryptocurrency was gaining legitimacy. Institutions were starting to take notice—Tesla bought Bitcoin, PayPal began allowing crypto transactions, and DeFi (Decentralized Finance) exploded onto the scene. I could see it clearly: crypto was here to stay.

2021 was a dream come true. Bitcoin hit new all-time highs, and Ethereum wasn’t far behind. My portfolio grew exponentially, and I finally hit the point where I felt financially comfortable. But the real story of 2021 wasn’t just about profits—it was about witnessing the transformation of the financial landscape. Decentralized applications, NFTs (Non-Fungible Tokens), and smart contracts became mainstream. Ethereum’s upgrade to Ethereum 2.0 was just around the corner, and there was a palpable sense of excitement in the air.

I also began investing in DeFi platforms, providing liquidity and earning interest on my crypto assets. Yield farming became a new frontier, and I dove into the world of staking and liquidity pools. I diversified further into projects like Solana, Avalanche, and Chainlink. Some investments were risky, but it felt like the opportunities were endless.

2022-2023: Market Maturity and Volatility

By 2022, cryptocurrency had matured. Governments were still grappling with regulation, and there were occasional market crashes (hello, Terra Luna), but it didn’t phase me as much anymore. The market was volatile, but I had learned to ride the waves.

I focused more on accumulating Bitcoin and Ethereum, seeing them as the backbone of the entire crypto ecosystem. I also got into NFTs, not just as an investment, but as a way to support artists and creators who were using blockchain for innovation. The crypto space had evolved from just a financial revolution to an entire cultural movement.

In 2023, I’ve shifted my mindset to a more long-term vision. My holdings have expanded beyond just coins. I’m deeply invested in layer-2 solutions like Optimism and Arbitrum, which I believe are the key to scaling Ethereum. I’m exploring emerging technologies like zero-knowledge proofs and privacy coins, and I’m starting to think about how I can contribute to the space, whether through development or simply educating others.

2024: The Future Ahead

Looking back on everything I’ve learned, it’s hard to imagine how far we’ve come. From the uncertainty of 2015 to the world of decentralized finance, NFTs, and smart contracts in 2024, it’s been an incredible ride. There were moments of doubt, mistakes, and losses, but there were also moments of triumph and growth. Crypto isn’t just about money anymore; it’s about being part of a movement that’s reshaping how we think about value, ownership, and the future of finance.

As I write this now, my portfolio is still growing, but my focus has shifted. I’m not just looking for the next big thing. I’m looking at the bigger picture—the long-term vision for a decentralized world. I’m excited for what’s next, because I know this is just the beginning. The journey I started back in 2015 is far from over.

And if there’s one thing I’ve learned, it’s this: In crypto, patience, research, and conviction are everything.